Learn how to avoid missing out on $1000s in Tax credits and richer benefits.

AUSTIN, TX, August 11, 2024 /24-7PressRelease/ — TexasPlans.com has released an in-depth guide designed to help residents of Texas accurately navigate the complexities of the Health Exchange subsidy income chart. This guide aims to ensure that individuals and families in Texas receive the maximum subsidy available to reduce their health insurance costs.

Understanding the Texas Health Exchange Subsidy Income Chart

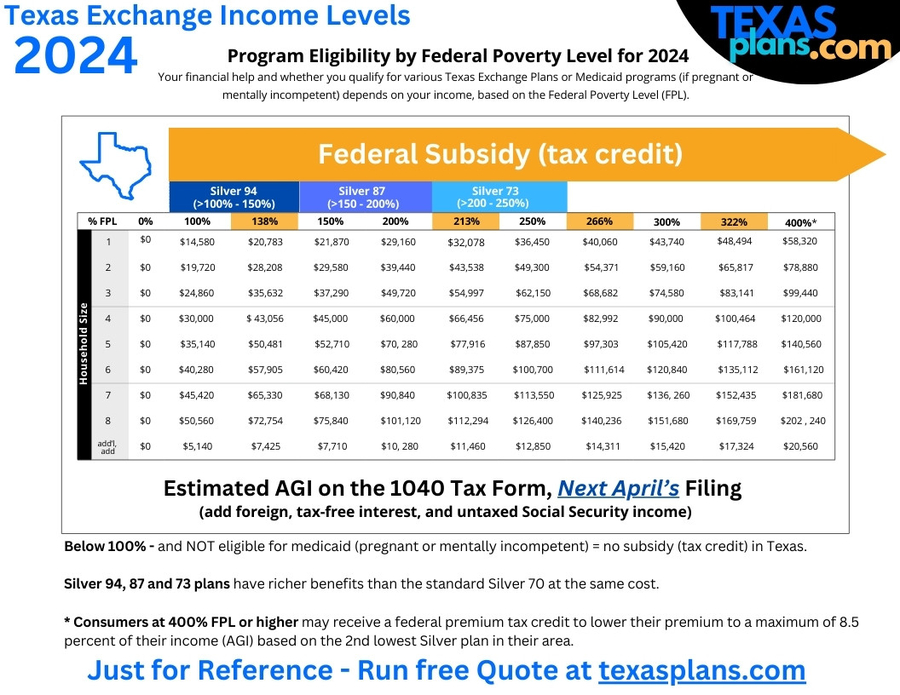

The Texas Health Exchange (Obamacare) subsidy income chart is a critical tool for determining the amount of financial assistance available to residents. Accurate income estimation is crucial for maximizing subsidies, and errors in this calculation can lead to significant financial consequences. The guide addresses these challenges by offering clear, practical advice on how to navigate this complex process.

Access to the full guide to Texas Obamacare income chart, providing detailed explanations of the income chart and its components. Read the full article here.

Key Areas Covered in the Guide

Income and Subsidies:

The guide explains how the subsidy (tax credit) can significantly reduce monthly health insurance premiums, sometimes down to zero, based on accurate income reporting.

Common Errors:

Insights into common mistakes that can occur during the self-enrollment process, particularly around income calculations, and how to avoid them.

Household Definition and Income Period:

Clarification on what constitutes a household for subsidy calculations and the importance of estimating the Adjusted Gross Income (AGI) for the current year.

W2 vs. Self-Employed Income:

Differentiation between W2 income and self-employed income, including how each type should be reported on the 1040 tax form to ensure accurate subsidy calculations.

Handling Variable Income and the Medicaid Trap:

Strategies for managing income that fluctuates throughout the year and understanding the risks associated with falling into the Medicaid range.

Impact of Income Changes:

Guidance on how to adjust income estimates throughout the year to avoid unexpected financial obligations, such as repaying subsidies at tax time.

Practical Application and Support

The guide emphasizes the importance of running accurate quotes and offers tools to help residents see how their income levels affect their health insurance options. Texas Plans also provides free assistance to help individuals correctly estimate their income and avoid costly errors.

The guide is designed to be a practical resource, helping Texans make informed decisions about their health insurance coverage. Free quotes are available through TexasPlans, which incorporates the insights from the income chart to provide accurate, personalized health insurance options.

Read the full article for comprehensive insights and begin your journey towards more affordable health care today.

Contact:

800-320-6269 or pick a time to talk here.

Chat online here

help@texasplans.com

TexasPlans.com

Use the income chart for Texas Obamacare to save the most money.

Texas Plans is dedicated to helping Texans navigate the complexities of health insurance. With extensive experience and a commitment to clear, accurate information, they ensure residents make informed decisions about their health coverage.

—

For the original version of this press release, please visit 24-7PressRelease.com here